Highlights of E-Book:

Property Tax

by Jon Wellington, J.D., Principal, State and Local Tax

The Texas Constitution exempts “Freeport goods” from property tax. Freeport goods include most inventory that leaves the State of Texas within 175 days from the date the taxpayer acquired, manufactured, or brought the goods into Texas. Taxpayers claim the Freeport Exemption by filing a timely annual application with their appropriate appraisal district, although the exemption is only available for the taxing jurisdiction(s) that previously elected to grant the exemption. The percentage of inventory eligible for the exemption is based on the taxpayer’s prior-year activity, and maintaining supporting documentation is critical. Appraisal districts vary in the documentation they require, but such documentation typically includes sales reports, inventory reports, and financial statements.

The Tax Credits You May Be Missing

by Callie Lemle, Principal, Assurance Services

In December 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law and considered to be the most significant piece of retirement-related legislation since the Pension Protection Act of 2006. Unfortunately, this sweeping legislation was heavily overshadowed by the enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. As a result, many employers are unaware of tax credits for retirement plans set forth by the SECURE Act that could be taken advantage of in the current tax year.

Sales Tax

by Jon Wellington, J.D., Principal, State and Local Tax

The manufacturing exemption is one of the most valuable sales tax exemptions available to taxpayers. Texas exempts tangible personal property that becomes an ingredient or component of an item manufactured for sale, and also exempts any equipment that makes a chemical or physical change in the product being manufactured and is necessary and essential in the manufacturing process. The exemption extends to any services performed on the manufactured product or manufacturing equipment.

Attracting and Retaining Talent (Video)

(9 min.)

by Jillian Hawkins, HR Manager

Jillian Hawkins talks about where to look for employees at all levels from the factory floor to the executive suite.

Remote Working or Return to Work (Video)

(7 min.)

by Candice King, HR Principal

Our HR Principal, Candice King, offers solutions to the lingering dilemma between working remotely and returning to the office.

Health and Wellness (Video)

(8 min.)

by Bailey Price, HR Coordinator

Bailey Price emphasizes how providing a health and wellness program can improve productivity and prevent burnout.

Diversity, Equity, and Inclusion (Video)

(5 min.)

by Candice King, HR Principal

Candice talks about how implementing a DE&I program can change a company for the better.

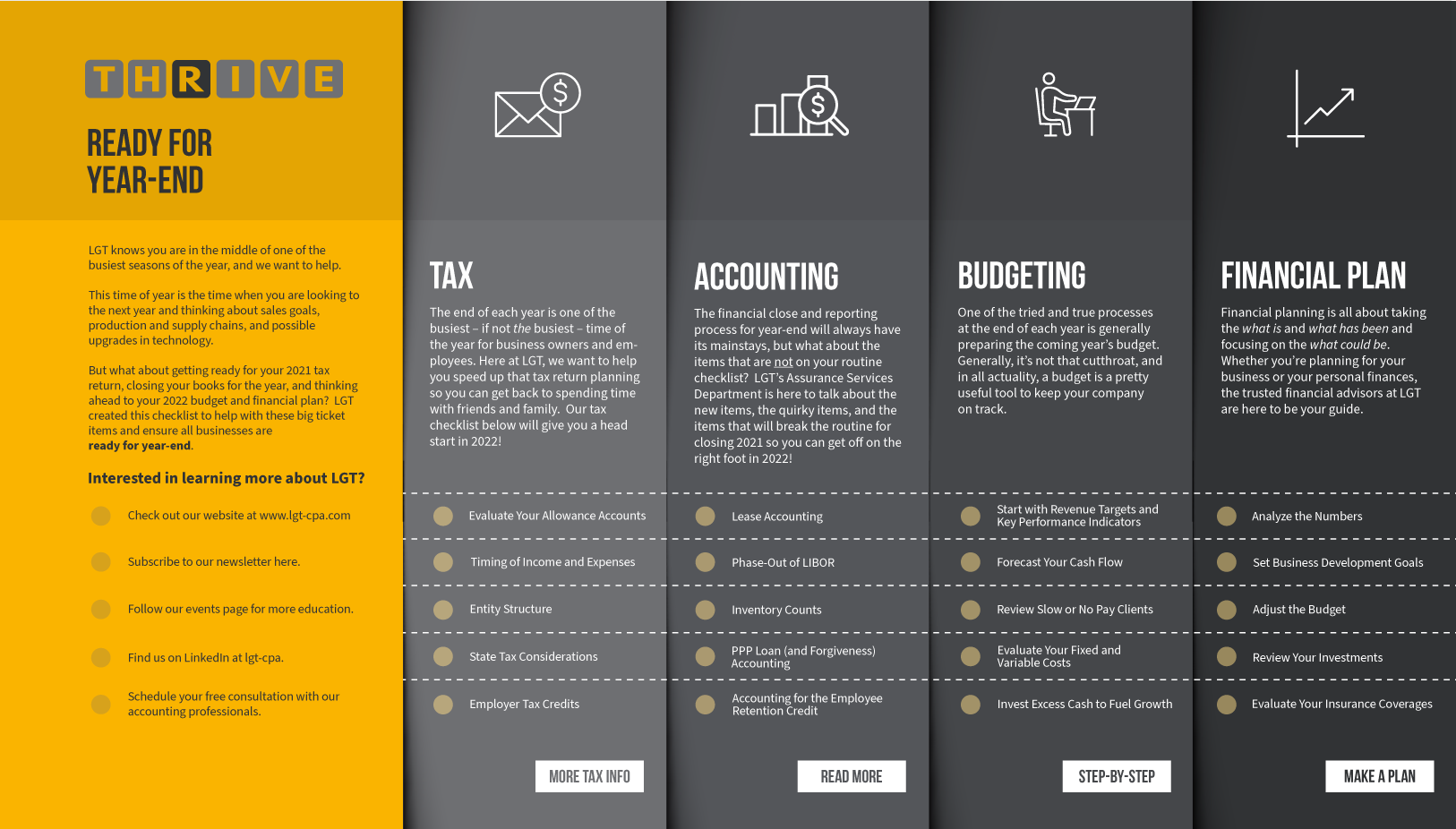

Ready for Year-End Checklist (PDF)

Multiple Authors

Gearing up for year-end can create a lot of stress. Find order in the chaos. Check out our checklists to help you deal with issues related to taxes, accounting, budgeting and financial planning. We have provided these checklists to assist you in wrapping up 2021 and preparing for 2022. At the end of each list is a link for additional information from some of our finest professionals within tax, audit, consulting, and financial advising. Let us help you get prepared, and if you need assistance, we are here to lend that helping hand.

As we begin a new year, we want to continue providing additional information that will be helpful to manufacturing businesses to assist in our ever-growing inventory issues.

Our professionals have laid out a simple guide with key tools to brighten up your supply chain initiative.

Inside the document we share guidelines through internal controls, turnover analysis, and inventory management, to help you THRIVE.

Cybersecurity in Today's Manufacturing (Video)

(6.5 min.)

by Keith Barthold, CEO at DKBinnovative

Our friend, Keith Barthold, CEO at DKB Innovative, provides his insight into the framework, tools, and suggestive ways to improve your IT infrastructure to protect you and your business.

Preventing Fictitious Vendor Payments (Video)

(6 min.)

by Sara Godecke, CPA, Partner, Assurance Services

One of our M&D partners, Sara Godecke, offers prevention strategies when it comes to your money and fictitious vendor payments.

Buy or Lease Large Equipment? (Video)

(5.5 min.)

by Lucas LaChance, CPA, CIA, Partner, Practice Growth

That is the question. With the new leasing standard in full effect, Lucas LaChance, partner of Practice Growth, explains which option would be best for your business that could benefit you long-term.

Many companies have at least thought about what will happen towards the end of their business journey and we have an assist for guiding you through the questions you may have. We have provided an interactive form that will help you navigate through the different stages of the decision when it comes to your exit strategy or succession plan and how your financial goals can be affected.

Find out which stage you are at within your strategy or select another option from our selections to determine which path will set you up for success.

(Click the image or you can click here for the form.)

Our M&D professionals are only a click away!

Let us help to provide you with the necessary tools and advice to help you succeed.

Fill out this simple form and someone from our M&D group will get back to you shortly.